option to tax form uk

If you do opt to tax you will need to charge the tenant. Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on.

The time limit for notifying an option to tax has returned to 30 days from 1 August 2021.

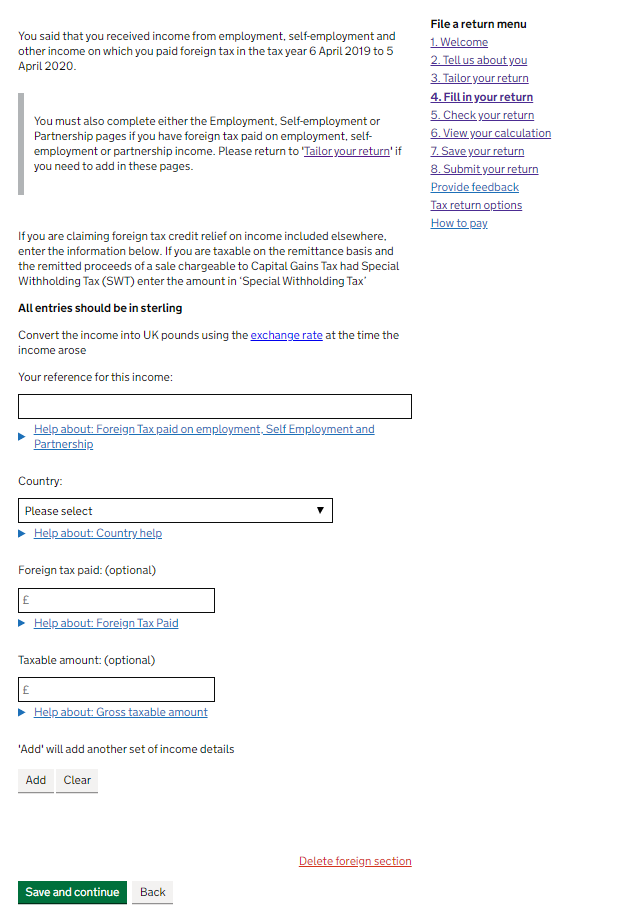

. If youre sending a tax return for the 2017 to 2018 tax year or earlier get forms from the National Archives. What is the Option to Tax. Then within 30 days they must notify HMRC of the decision typically using a completed form.

Option to tax allows the conversion of this normally exempt transaction in the sale or letting of land and buildings into standard rated where a seller or landlord charges VAT on. I tend to remember option to tax forms by their numbers and letters. The temporary change to the time limit to notify HMRC of an option to tax during coronavirus COVID-19 has ended.

Download and fill in form SA100. Register for VAT if supplying goods under certain directives. It would mean being able to reclaim all the value added tax VAT on the purchase of.

As it is a new commercial property you will be charged VAT. For example you need a VAT 1614A in a different situation to a VAT 1614D. Rent it out without opting to tax and you wont be able to claim the VAT back.

To opt to tax a person must first make a decision to opt normally at a board meeting or similar. UK Property Accountants is a leading. Sending a tax return if youre not an individual.

The option to tax form can be found on HMRCs website and can be submitted with an electronic signature but HMRC has suggested that it will also require evidence that the. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was made. The main difference between the two forms is that you are asking for HMRCs permission to opt to tax with the latter form whereas FormVAT1614A is a notification process.

The option to tax allows a business to choose to charge VAT on the sale or rental of commercial property ie. If you are notifying us of a decision to opt to tax land and. Notifying HMRC that option has been exercised by submitting option to tax form within 30 days from the date when the decision to opt was.

Provide partnership details when you register for VAT. An Option to Tax arises only with commercial property or land and when you decide to sublet it or sell it on. To make a taxable supply out of what otherwise would.

Form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are. However the ability to sign these forms electronically has been made permanent.

Cryptocurrency And Non Fungible Token Nft On Divorce Dissolution Family Law Partners

2020 Tax Year Forms And Schedules File Your Tax Return

Best Tax Software Of October 2022 Forbes Advisor

Do I Have To Complete A Tax Return Low Incomes Tax Reform Group

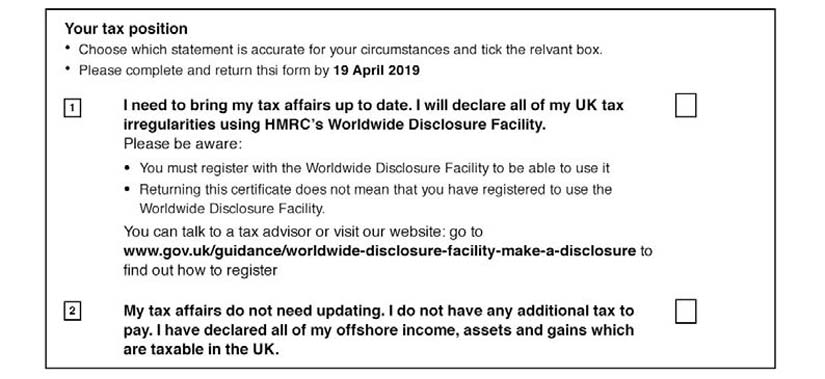

Certificate Of Tax Position How To Complete It

What Is Corporation Tax Guide For Small Companies Bytestart

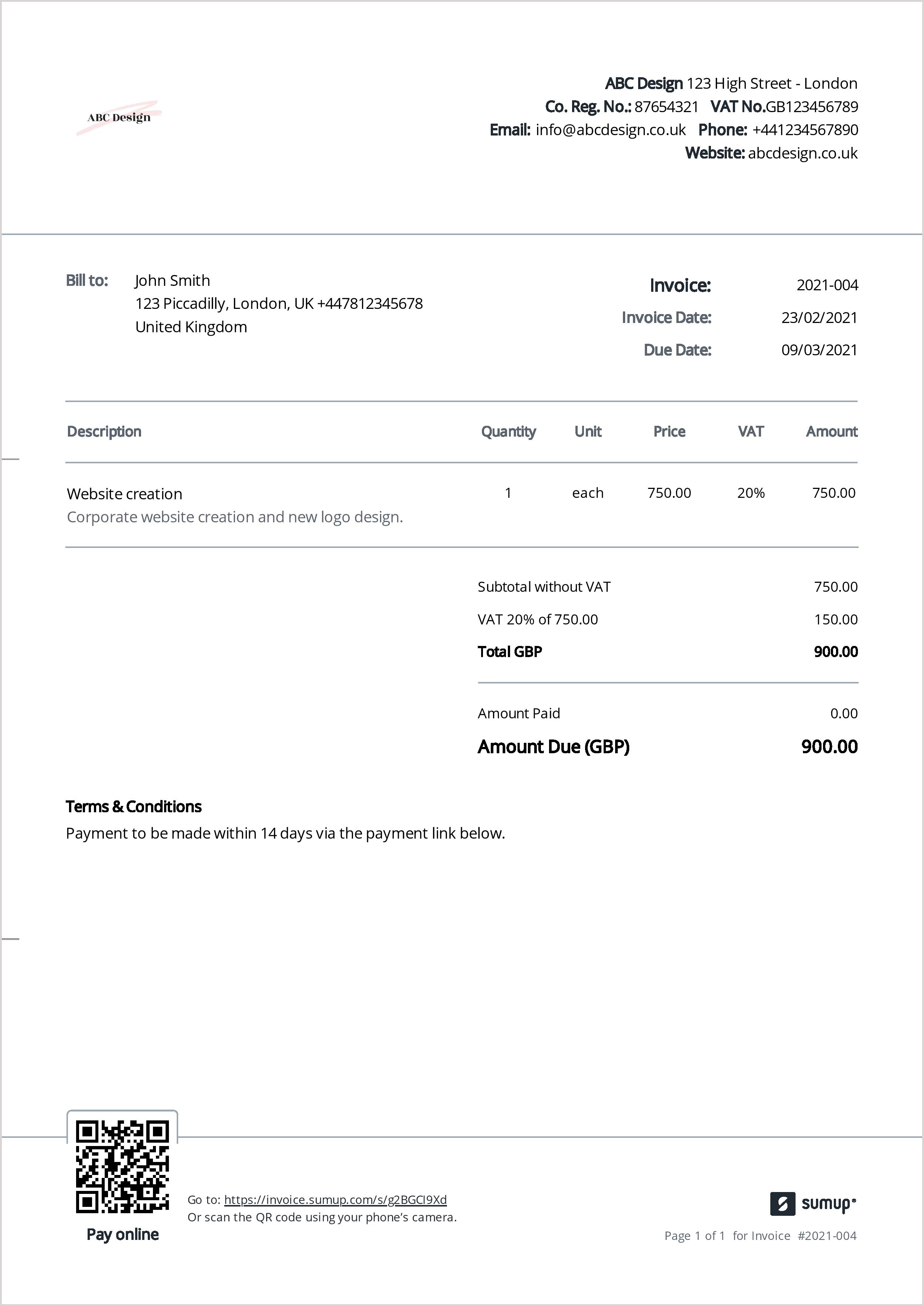

What Are Vat Invoices And Who Needs To Issue Them Sumup Invoices

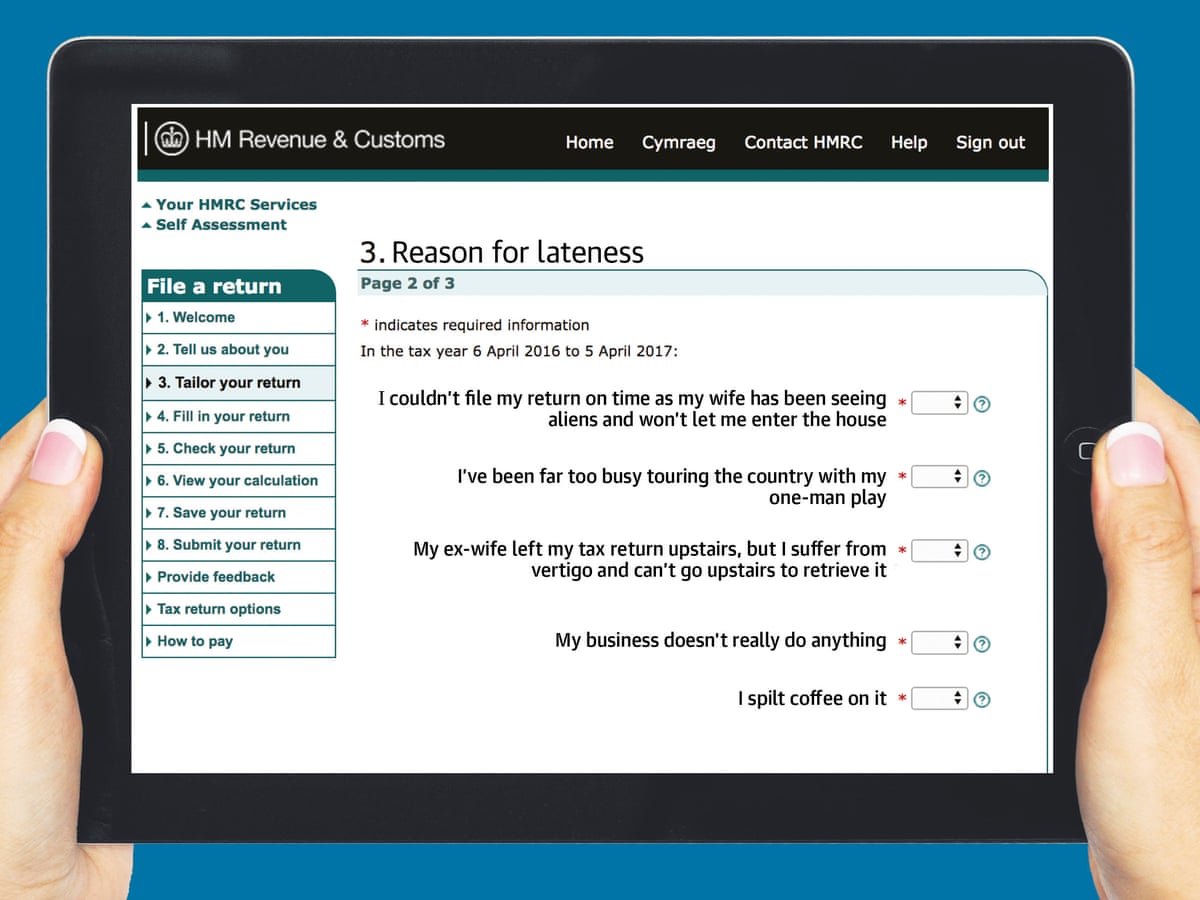

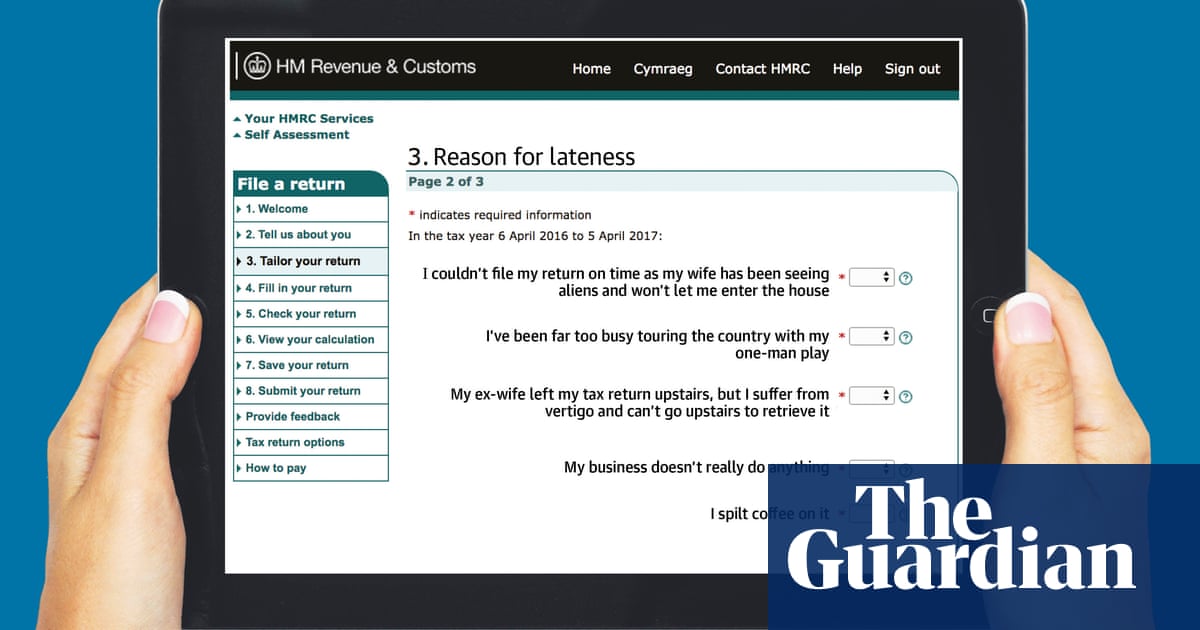

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

Hmrc Waives Penalties On Filing Uk Personal Tax Returns Late Financial Times

Contact Hm Revenue Customs Gov Uk

Hmrc Customer Support Twitterren Matthewobaker Once You Have Filled Into The Sa1 We Will Reactivate The Sa Record We Will Send You A Notice To File By Post Once This Is Issued

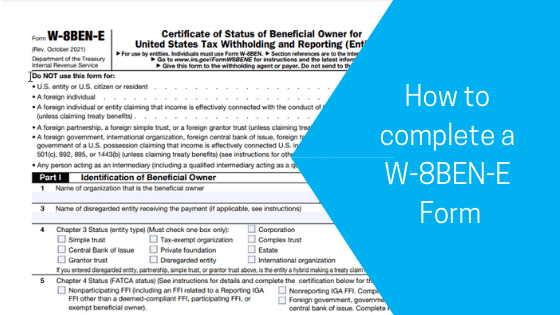

How To Complete A W 8ben E Form Caseron Cloud Accounting

Form W 8ben Definition Purpose And Instructions Tipalti

Uk Tax Returns Here S How To Tackle Yours Now Income Tax The Guardian

2009 Form Uk Hmrc Vat1614j Fill Online Printable Fillable Blank Pdffiller

Vat And The Option To Tax Part 1 Accountingweb

How To File Your Uk Taxes When You Live Abroad Expatica

How Are Gains Income Distributed Between Investment Club Members When Generating Form 185 New Timetotrade